If you had money to invest, where would you put it?

This blog post is about the biggest investment you might ever make, investing in a home. Before we begin, let's start with a question that may be on your mind. Is buying a home in Rapid City a good investment?

Overall, there are many opinions on this matter. Read this article about John Paulson, Billionaire money manager and his take on how investing in a home is still one of the best investments you can make. There are differing opinions, as read in this article.

These opinions can be confusing, and neither of the articles above are local. This is why I want to give you a localized view and answer a few of your other home buying questions.

Is the real estate market in Rapid City stable?

Let me explain. In the midst of the “Great Recession,” while other real estate markets were bottoming, we were steady.

Data Source: Federal Housing Finance Agency (FHFA), First Quarter, 2009.

State Annual Price Increase or Decrease RankingAlaska 4.79% 1Oklahoma 0.30% 2North Dakota 0.30% 3South Dakota 0.29% 4Kentucky -0.54% 5Texas -0.58% 6Missouri -0.67% 7North Carolina -0.80% 8Arizona -19.51% 48California -22.12% 49Florida -22.46% 50Nevada -31.10% 51U.S. Average -7.1% -

Above information from azhousing.gov

This means that flipping homes in Rapid City can be a bit more difficult, but if you are going to invest your time and money in a home in the black hills, you are in good shape!

How is the real estate market in Rapid City now?

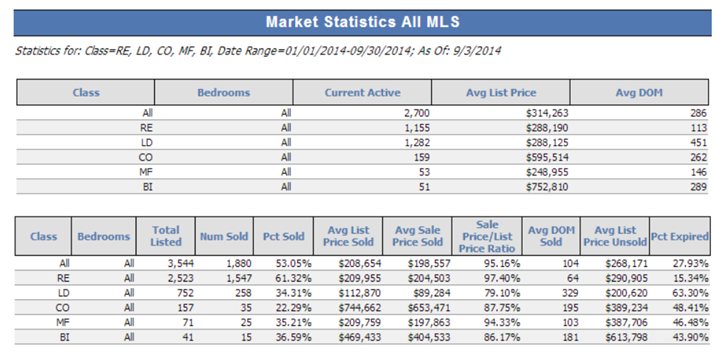

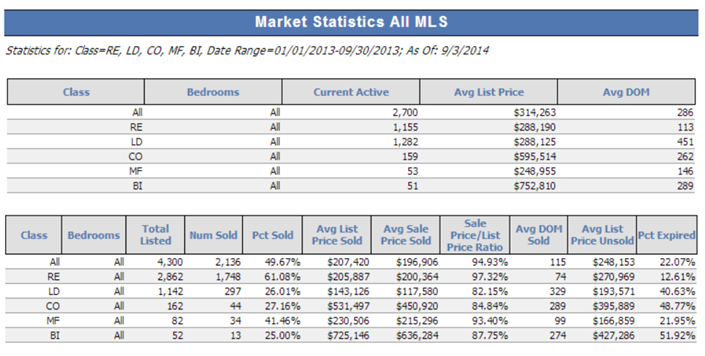

Let's take a look at our MLS statistics. The first graph is from January 1st through September 3rd of 2014. The bottom graph is from January 1st 2013 to September 2014. A year's difference.

Let's compare all listings, the first row on each graph.

While the number sold from this year to last is lower, the average list price and average sale price is higher than 2013. The sale price/list price ratio, (the price the property was listed versus what it was sold for) was higher. Also, the average Days On Market was less than in 2013. This means the property has sold faster, what seller or buyer would take that as bad news?

In conclusion, as a buyer looking to invest in a home, you can count on the appreciation statistics in Rapid City. We all now that a home is not only an investment, but a place for comfort and security.

We want to help you find your biggest investment, security and comfort.

Have more questions about the black hills real estate market? Contact Exit Realty in Rapid City for any and all of your real estate needs. 605-716-3948.